One question I have been asked recently a number of times is: Why all the sudden are my wealthy friends investing in farmland? This is generally followed by: Should I be considering it?

Let’s start by looking into a place that few investor grade people would usually even think of when wanting to get into land banking: Iowa.

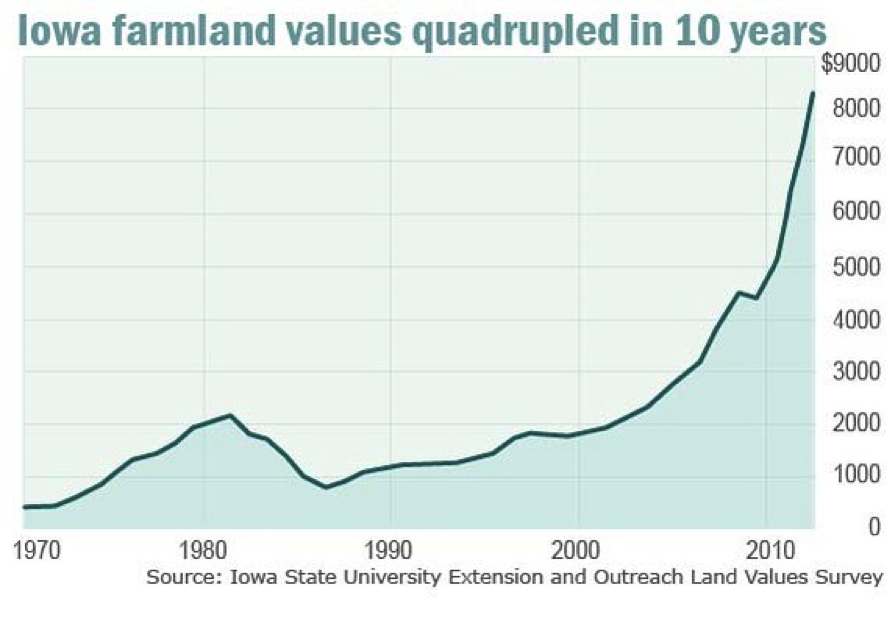

Iowa, like many of states harboring vast quantities of farmlands, has been the recent target of wealthy investors looking to get in on the farmland boom which has taken flight over the past ten plus years. A recent survey of greater than 30 million acres of farmland in the state has shown that the average value of high-quality farmland is hovering around $11,500 per acre. Even the middle-of-the-road farmland is going for a cool $8,300 per acre.

This is a huge increase in value over time, as you could easily purchase the same farmland for about $1,500 per acre as recently as the 90’s. We all know that the value of land goes up, but this leaves many people with an open mouthed “Wow.”

To put it another way, Iowa State University published a study which demonstrates that the average purchaser of farmland at the turn of the millennium, who sold their land in 2015…just a decade and a half later…has earned a 12.6% annualized return on that investment. This data doesn’t even include the return garnered from the actual business of the farm in production, simply the increase value of the land over time.

So what this means is that farmland has consistently beat the stock market since the mid 90’s, and created many millionaire farms and even more happy investors. With an average size of over 330 acres per farm, the average value of that land has risen from under $500,000 to over $4,000,000 in that time.

I think that answers the first question above, in terms of “Why” people are investing in farmland. As for the second question “Should I be doing it?” I would say that if you are the type of person who follows start money, and has the patience to identify market sub-cycles and good deals, then you should most definitely consider buying and holding onto some high-grade farmland for the next 10 to 15 years, and cash in on this incredible investment trend which shows no signs of slowing down anytime soon.

Latest comments